Loan servicing enhancement update: All you need to know

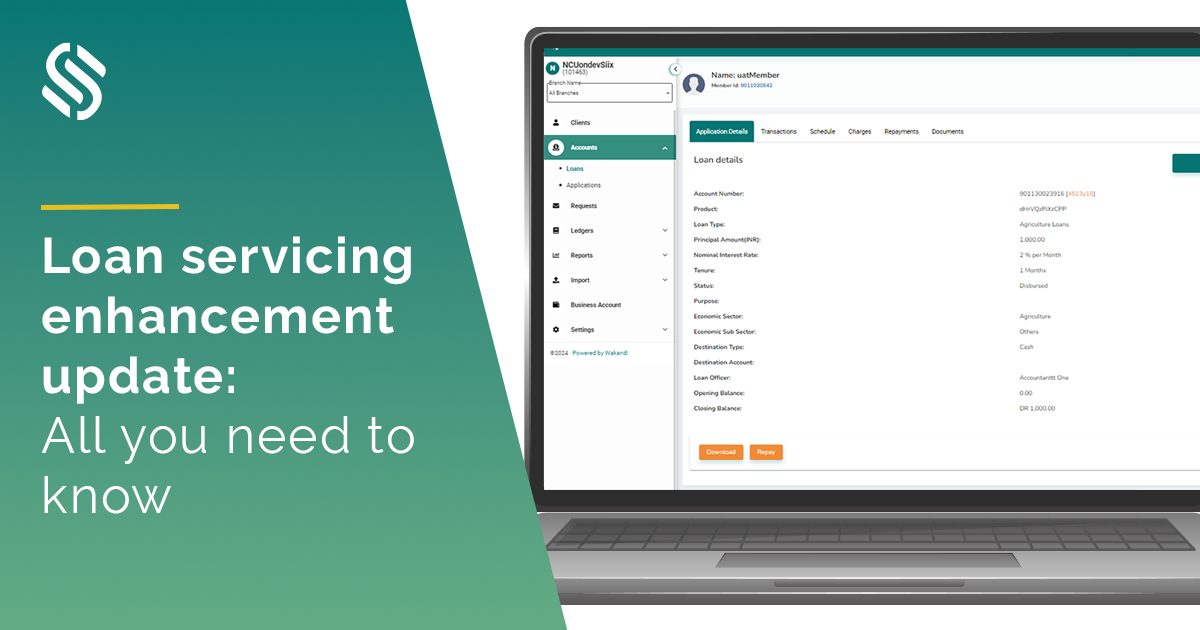

Loan processing and interest calculation are amongst the core offerings of the Wakandi app. We have brought new updates to these features to enhance the functionality further and provide a hassle-free experience to our users.

Imagine recording, tracking, and updating your loan offerings through Wakandi where you get a feature for each requirement. This new update streamlines the entire process from loan disbursement to loan repayment – due dates, repayments, and arrears. Wakandi meets all your loan-related requirements easily.

Here are all the latest changes made to the loan servicing part of Wakandi that you need to know.

Accrual process

We have made significant changes to how accrual entries are handled in the account books. Accrual entries are automatically generated in the books when the due date of loans arises. You don’t need to make manual entries as they are created based on the loan details you have filled during the disbursement stage.

With this new update, Wakandi smartly understands if there is a difference between the accrual dates and payment dates and manages your account entries:

In case of payment after the accrual date

If the member doesn’t pay on the accrual date, Wakandi will automatically charge the fee from the member for the delay. This time, the instalment received entry will also include the late fee charged to the member.

In case of payment before the accrual date

Members of your cooperative can easily pay the instalment before the accrual date through online or offline channels. In this case, when the member has paid before, a direct payment entry will be made in the account books on the date of the payment received. The accrual entry of that instalment will not be created.

In another scenario, when a member pays only a part of the instalment and not the complete payment, Wakandi will only accrue the remainder and make the entry accordingly.

Repayment of loan

Wakandi brings all information related to loans in one place which makes managing repayments super easy. You can track and manage active loans, due dates, instalments, mode of payments and other details easily.

With this new update, you can separately check the total outstanding amount as well as the due amount as per the current repayment date. Such information can help you manage loan repayments by members easily in case of unplanned payments. The information is available at various places for easy accessibility:

- Teller page in the Admin Panel

- In the list of loans in the Member App

- In the USSD menu at the time of loan repayment

Overpayment

This new update also provides members with the ability to pay off the loan sooner than the final due date. This will help the members who might want to repay the loan earlier to save some cost on interest.

To help admins like you, Wakandi automatically charges the interest based on the number of days before the loan was repaid and makes accurate entries in the account books. This saves you from the time and complications involved in calculating interest, especially in reducing balance methods.

Arrears on holidays

A small but essential function of this update is that you can move the due date of any loan if it falls on a public holiday or a non-working day. This can help both the management and members ensure timely repayments and avoid confusion. To further avoid late repayment in cases of emergency holidays or unavailability of the management, you can add a grace period after the due date.

What’s next?

We at Wakandi aim to meet your expectations when it comes to offering financial services to your members and make it simple and stress-free for you. In the coming weeks, you can expect more such updates that can help you save time and effort, and make your life easier.

Be the first to know about all the latest updates in Wakandi.

Comments