Re-imagining finance in Kenya after the pandemic

COVID-19 brought substantial disruption in the finance sector in Kenya. Kenya’s GDP growth slowed down to -0.3% in 2020 – a record low since 2008. Banking operations and financial performance were severely impacted by lockdown restrictions. Cooperative societies had to shut off their operations as Mobility was restricted and social gatherings were prohibited.

According to Saccotimes, the rate at which SACCOS disburse loans went down significantly due to limited uptake by members. Withdrawals went high due to the cash crunch.

Although the pandemic posed severe consequences for millions of people worldwide, it has triggered a tremendous acceleration in the digital transformation of the global economy. As the global pandemic continues, the finance sector in Kenya will witness some substantial changes with the higher adoption of technology.

Let us explore various trends that we believe will continue transforming the financial sector in Kenya in the post-pandemic world.

Digital banking revolution

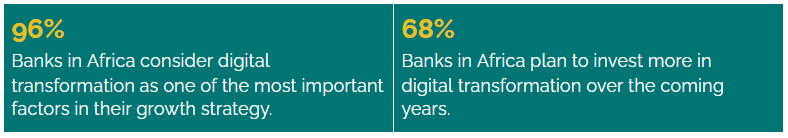

The COVID-19 pandemic and the containment measures have created a spur in the banking sector. Banks in Kenya will continue accelerating their efforts towards digital transformation.

Banks will move towards digital systems to provide banking services to millions of consumers. With these systems, various services like savings, loans, insurance, investments, and financial services can be managed online.

This adoption of digital banking services may also lead to newer partnerships with fintech startups and companies. It can help banks unlock newer possibilities for bringing their customers online and offer personalized solutions.

Mobile money adoption for cooperative societies

The need for more sophisticated financial systems has become more evident for cooperative societies in Kenya. Strong uptake of mobile wallets and mobile transactions is expected as cooperatives continue to get back on track.

There are 9.2 million people associated with credit unions in the country, saving around $13 billion, according to WOCCU’s statistical report 2020. The adoption of mobile technologies in managing cooperatives can bring several benefits to the members. The most important ones include:

- Better financial inclusion

- Digitization of the informal economy

- Empowering women, youth, and poor

With mobile money adoption, the demand for digital financial platforms to manage savings and loans is expected to rise. More and more SACCOS will explore such platforms to go completely digital and solve various challenges linked to traditional practices.

As a technology-driven company, we aim to simplify how cooperatives in Kenya operate. We have built a Credit Association Management System (CAMS), a digital system to help SACCOS and microfinance institutions offer financial services digitally. With CAMS, members can use their mobile wallets to send contributions, apply for loans, and manage their finances online. It can also help perform various admin-related tasks to make SACCOS management smoother and more secure.

Crypto adoption

Crypto adoption in Kenya has grown rapidly in the last few years. The Global Crypto Adoption 2021 report by Chainalysis has ranked Kenya 5th in the world in terms of cryptocurrency adoption. According to the report, Kenya is ahead of many developed countries including China, America, and Russia.

As Kenyans lean towards digital payments, the adoption of cryptocurrencies and digital coins will continue to rise. We believe this form of digital money will gain more use cases in the near future such as retail payments, including groceries and daily goods, and money transfers.

Comments