How fintech is changing payments in Africa

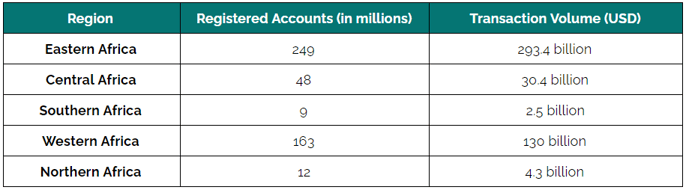

Ever since the launch of M-Pesa by Safaricom in 2007, a wave of digital payments has risen in Africa. Over the years, Africa has become a global leader when it comes to mobile payments. According to GSMA, more than 45% of global mobile accounts belong to Sub-Sharan Africa, taking the continent’s total to 481 million registered accounts. Eastern Africa has led the transformation to digital payments, with around more than half of the total mobile money accounts transacting over $290 billion.

More people are using mobile phones to make a variety of payments. Mobile money drives instant and secure payments in international remittance, healthcare, education, retail stores and even salaries.

According to a report by GSMA:

- More than one-third of people with mobile money accounts receive their salaries via mobile money.

- Utilities account for 61% of mobile money bill payments.

- 7 out of 10 mobile money providers partner with agribusinesses and cooperatives to provide subsidies, reimbursements, and salaries.

Today, digital transactions make up the majority of African mobile money flows. In December 2019, it was the first time Africans made more than half of the transactions through mobile. That means Africans dethroned cash as the primary mode of payment in Africa.

A hotbed for fintechs

The continent has become a hotbed of financial technology (fintech) and innovation. Not just mobile network operators, fintechs and innovators are entering the market from around the globe to promote better financial services.

Digital payments in Africa are booming and becoming a ground of opportunities for many tech giants and fintech startups. Big companies, including Visa and Mastercard and public and private banks, collaborate with tech startups to build the new payment landscape.

The continent has over 473 active fintechs. Many reports and news showed that VC funding for African fintech startups rose by 51% in early 2020. The new fintechs raised around $350 million during the first quarter of 2020. The funding majorly generated for projects like online banking, consumer credit checks and innovative financial products and services.

South Africa took the biggest chunk with $112m in funding, followed by Nigeria with $74m, Kenya at $62m and Egypt, which raised $51m.

Bringing transformation to payments

The origin of Africa’s fintech revolution was mobile money. Today, fintechs in huge numbers are entering the African market, intending to change finance completely. Let us see what fintechs have brought to Africa’s payment landscape.

Ease and speed of transactions

Africa has always been a cash-driven region. Fintechs like SamPay and EverSend aim to utilize what mobile money providers have laid down by building services to make instant payments. These apps link to mobile accounts, bank accounts, and wallets, enabling users to make speedier payments. They also allow paying for bills, sending money, paying salaries, and receive payments anytime, anywhere.

Security and traceability of transactions

Issues related to the security of money transactions are gaining significant importance. Fintechs rely on emerging technologies such as blockchain and artificial intelligence to bring better traceability and avoid fraud. The use of blockchain can also reduce the chances of risk related to transaction security or identity theft. Cellulant is an African startup that aims to simplify and secure payments with the help of blockchain technology.

Good governance and banking

The rapid adoption and use of digital payment services by fintechs have brought millions of Africans to the tax net. This enabled banks and governments to keep track of financials while creating regulations and building services following people’s needs. And will help them to continue serving them better.

Launching cryptos and digital coins

Cryptocurrencies and digital coins are booming in Africa. Thanks to the innovative fintech startups that are exploring blockchain to build a new age of finance. Kenya’s BitPesa, EDAS in Tanzania and many other fintech companies are leading the way to virtual money for millions of Africans.

Looking forward

Digitally transforming the payments in Africa is not an overnight task. It will require constant innovation and collaboration with banks, payments processors, and technology companies to build the digital economy. More than ever, fintechs are poised to become the stepping stone for a financially enabled society.

Comments