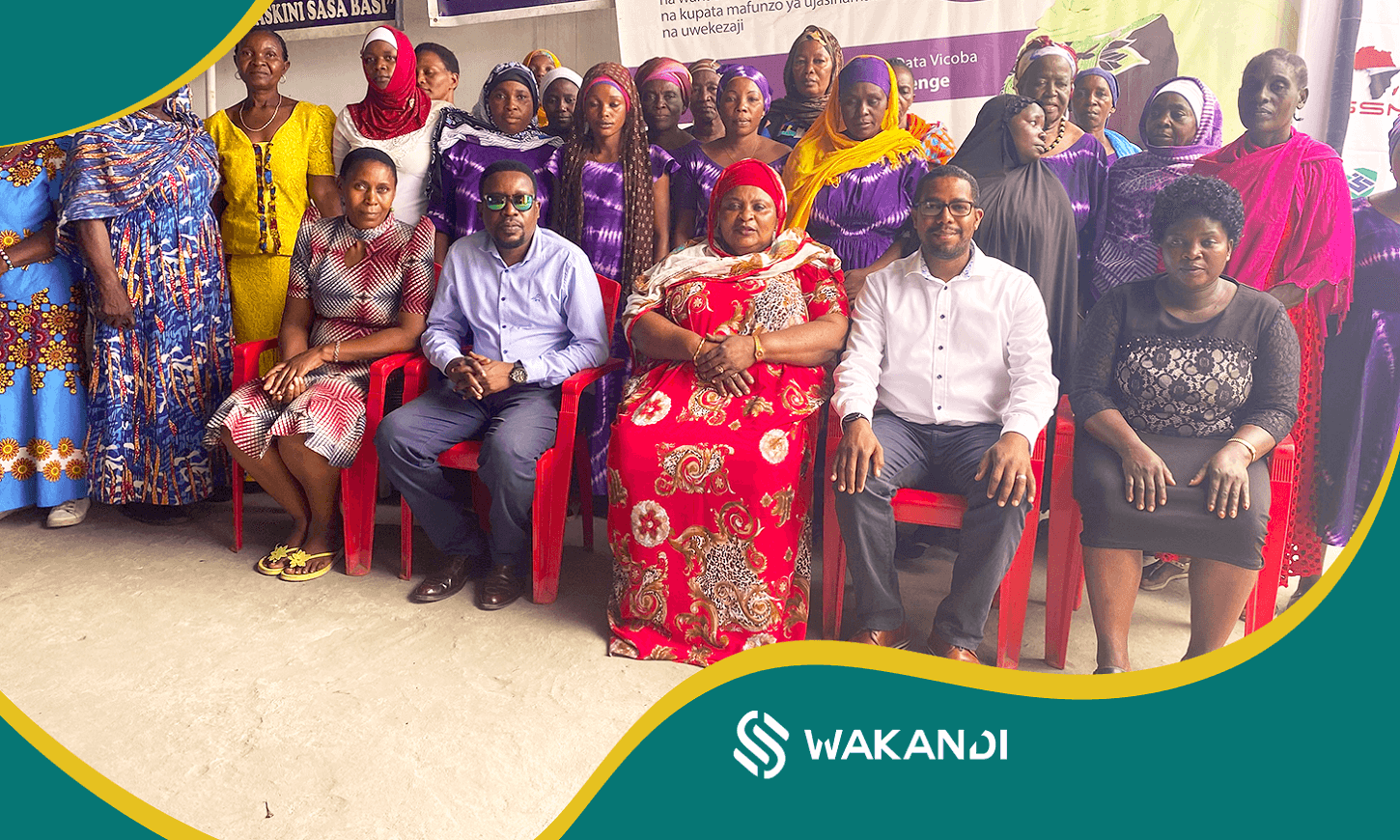

Enabling savings groups to improve women’s financial inclusion in Africa

Over the last two decades, informal financial groups (IFGs) have emerged as a crucial strategy in promoting women’s financial inclusion in Africa. The community-based savings groups saw a massive growth in the 1990s. Today, they are promoted by governments, local and international NGOs, and banks across the continent.

The rules of such groups are simple – anywhere from 10 to 50 women come together to form a group for a specific purpose. Every week or month, they put their savings together. Any member can avail a loan and must repay it within the stipulated time, paying interest at the rate of 5-10%. The interest is used to increase the capital of the group.

Savings groups and women’s financial inclusion

Many savings groups have successfully strengthened women’s situation in rural areas, increasing their savings and loans activities. These women have gained knowledge to pursue education, learn new skills, grow their businesses, and empower themselves to support their families. Women’s participation in these groups also led to their improved participation in social affairs, ownership of house and land, steady income sources, and using funds for domestic chores. It is estimated that there are more than 700,000 active savings groups globally, comprising more than 14 million members, 80% of whom are women.

There are many good reasons to celebrate the massive growth in boosting women’s financial inclusion in Africa. However, a significant gap for improving access to financial services among women still remains.

Many of the constraints to increasing women’s financial inclusion include – the demand for a quick and secure way of transactions, dependence on cash, adverse social norms, digital illiteracy, gender gap, lack of proper documentation, and more. That is where Wakandi comes in with its solution that aims to boost financial inclusion in Africa. Our Credit Association Management System (CAMS) can help improve how IFGs operate, ultimately benefiting their members.

What can CAMS offer?

CAMS is an application based on Wakandi’s infrastructure that enables IFGs and microfinance institutes to manage savings and loans effectively, bringing a ton of benefits:

- Speed – Enable digital transactions and systems over traditional processes for speedier transactions, quick reconciliation and loan settlements.

- Security – Brings better security against theft and frauds as cash transactions will be eliminated. There will be no need to pay or store cash, giving members a sense of safety and security.

- Innovation – Open doors to adopting technology and innovation right from making transactions and maintaining records to offering new and innovative services.

- Collaboration with banks – CAMS create a hub of transactional data that can be shared with banks and financial institutions. The data can help them build better products and services targeted to their customers’ needs and requirements.

Read more about CAMS here.

Conclusion

The growth of formal financial institutions like banks has been low compared to IFGs. More than 370 million people in Africa are unbanked. Moreover, less than 30% of women have an account with a financial institution. The situation is even poor in rural areas, young women and other marginalized populations. While several efforts have been made to reduce the gender gap, it remained static for years. Wakandi’s CAMS could be an effort to increase financial inclusion by enabling better collaboration for banks and supporting women empowerment. We are moving towards the final phase of development of our solution and will be launching soon in Tanzania, South Africa and The Gambia. Stay updated with all the latest happenings at Wakandi by subscribing to our newsletter below.

Comments